Corporate & Financial Accountability

While many corporations take legal compliance seriously, others engage in conduct that violates the public trust. Through influence peddling, campaign contributions, lobbying, and job offers to highly placed regulators, many corporations seek to undermine enforcement so as to mitigate punishment or escape scrutiny altogether. Moreover, the increasing privatization of public services and the reliance of government on private contractors weakens the ability of the public to properly ensure that the government is responsible to the constituency that it is expected to serve. Many of the largest, richest, and most powerful corruptors of government are corporations. There can never be government accountability without widespread corporate accountability.

We investigate and substantiate corporate whistleblower allegations having to do with tax evasion, government regulatory violations, and substantial public harm and design campaigns to address corporate corruption. In addition to representing corporate whistleblowers and developing legislation to protect them, we take legal action to recover fraud against the government, challenge tax evasion, and remedy dishonest corporate behavior against shareholders, workers, and consumers.

History

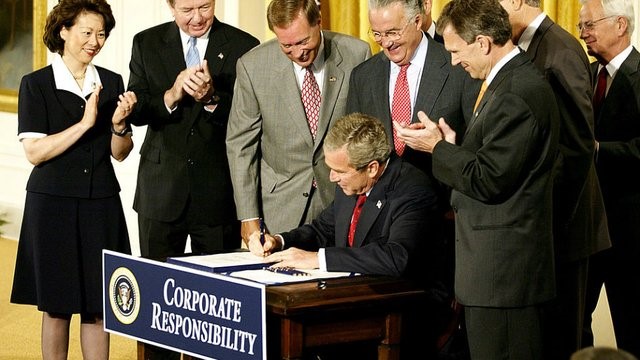

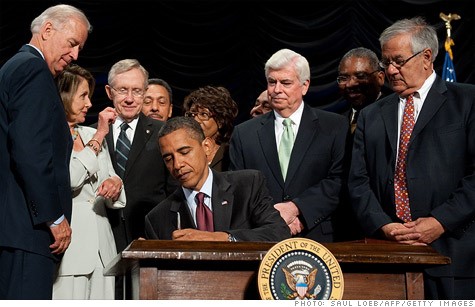

Government Accountability Project’s Corporate and Financial Accountability program has helped draft and enact the majority of significant corporate reform laws over the past 40 years. In 2002, following the collapse of Enron, Government Accountability Project helped push through landmark corporate reform legislation in the form of the Sarbanes-Oxley Act (SOX). Following the 2008 financial crisis, Government Accountability Project again was at the forefront of the effort to rein in corporate excess and ensure that those who blow the whistle on corporate corruption have the support they need to make their disclosures matter. In 2010, Government Accountability Project helped to enact the Dodd-Frank Wall Street Reform & Consumer Protection Act. Dodd-Frank and other corporate reform laws developed since 2007, with the help of Government Accountability Project, have expanded whistleblower protection coverage of corporate employees who had previously had only minimal legal protection. Over 80,000,000 corporate employees now benefit from substantial coverage by whistleblower protections.

Legislation

Sarbanes-Oxley Act of 2002

In 2002, the landmark SOX law for accountability at publicly-traded corporations opened new doors for whistleblowers by giving them access to jury trials in court when they fail to obtain a timely ruling at the Department of Labor. Recent amendments to that law now allow employees 180 days to act on their rights; override mandatory arbitration provisions in employment agreements; bring subsidiaries of parent companies into the law’s coverage; and explicitly provide for jury trials.

For a detailed explanation of the SOX whistleblower provisions, taken directly from The Corporate Whistleblower’s Survival Guide, please read here.

Dodd-Frank Act of 2010

The Dodd-Frank Wall Street Reform & Consumer Protection Act of 2010 includes gold standard whistleblower protections, ensuring greater enforcement of the law. There are four provisions strengthening whistleblower rights:

- Allowing whistleblowers to report wrongdoing directly to the SEC – not requiring employees to first approach their own corrupt companies.

- Making illegal any action taken by employers against employees in retaliation for approaching the SEC or in working with investigators.

- Providing protections for employees who disclose wrongdoing at subsidiaries, not just publicly traded parent companies.

- Implementing a reward program for individuals whose original evidence leads to successful enforcement action by the SEC yielding monetary sanctions of over $1 million.

Filing a Complaint with the DOL

If you believe you were discriminated against for whistleblowing in violation of either the SOX or the Dodd-Frank Wall Street Reform Act, you should consider filing a complaint with the Occupational Safety and Health Administration (OSHA) within the US Department of Labor.

Banking and Finance

Bank Whistleblowers United: In 2017, Government Accountability Project undertook the fiscal sponsorship of Bank Whistleblowers United (BWU). BWU is comprised of four prominent Wall Street whistleblowers who identified high-level wrongdoing by the nation’s largest financial institutions and the federal government. These experts provide subject-matter expertise to Government Accountability Project, the public, the financial sector, and regulators. The mission of BWU is “to create urgent, fundamental changes to break Wall Street’s power over our economy and our democracy.” BWU therefore specializes in developing strategic actions to curb the financial sector’s corrupting influence on politics and government regulators, as well as providing a detailed methodology to restore the rule of law to Wall Street, end too-big-to-fail and restore the best features of the Glass-Steagall law that used to govern bank activities.

Whistleblower Profiles

Michael Winston

Michael Winston Michael G. Winston was a high-level executive at Countrywide Financial tasked with writing a report about Countrywide’s succession planning and other governance issues to allay concerns expressed by Moody’s Credit Services. Winston refused to write the report as he had seen no succession plan, nor knew if one even existed. Soon afterward, his budget was frozen, his duties curtailed, and when Bank of America took over Countrywide in 2008, he was [...]

Sherron Watkins

Sherron Watkins Sherron Watkins was Vice President of Corporate Development at Enron, a Houston-based energy company that grew to employ 20,000 staff and claimed revenues of over $100 billion in 2000 before its collapse in 2001. After recognizing accounting irregularities within the company, Watkins alerted then-CEO Ken Lay in a 2001 memo, warning that Enron “might implode in a wave of accounting scandals.” Watkins’ internal disclosure eventually led to a Securities and Exchange [...]

Richard Bowen

Richard Bowen As a business chief underwriter for Citigroup during the housing bubble and subsequent financial crisis, Richard Bowen repeatedly cautioned executive management and the board of directors that roughly 60 percent of prime mortgages were defective. He also warned about risks associated with Citigroup’s practice of lowering its standards for subprime mortgage pools. His warnings were ignored, and Citigroup eventually stripped him of all responsibilities, placed him on administrative leave, and told [...]